The Economic Heartbeat: Between Bitcoin and Global Challenges

By Mario Figlioli for Kulassa, featured in Italian Gaze: Discovering Qatar Marketing and Business

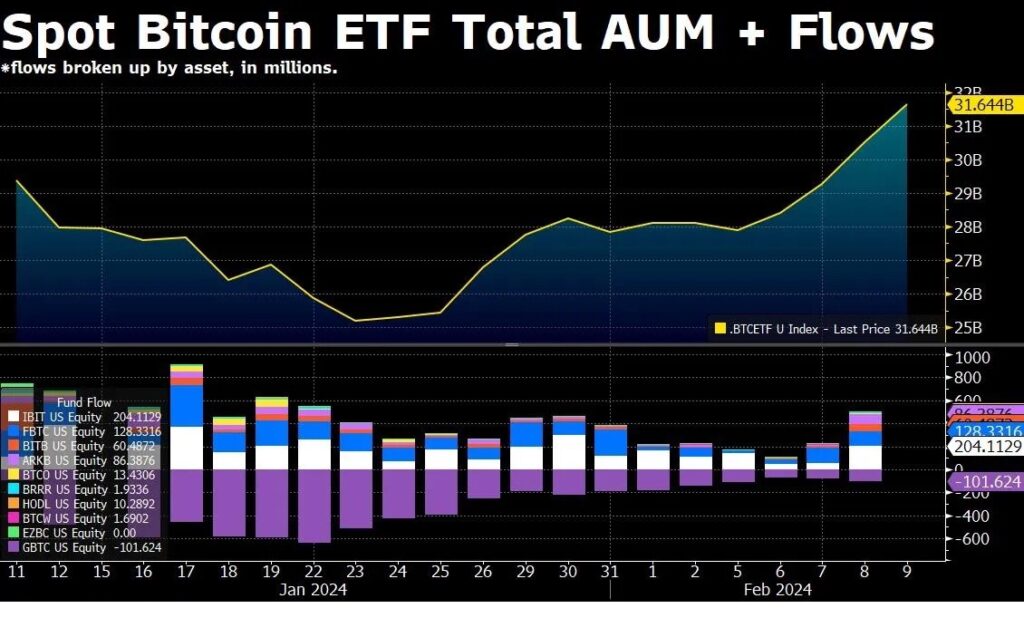

We are witnesses to how a month of trading Bitcoin ETFs in the USA has redefined not just the value of a cryptocurrency but also the concept of investment and ownership in the 21st century. With 10 funds launched in January gathering an impressive total of $31.6 billion in assets, about 670,000 BTC, we are faced with a financial landscape that challenges conventions.

Wall Street, now the largest holder of Bitcoin, prompts us to reconsider the meaning of “ownership” in a digital age. It’s a reminder: the true power of Bitcoin, or any asset, is realized in its direct possession. However, these ETFs open the door to exposure to the crypto world that many find irresistible.

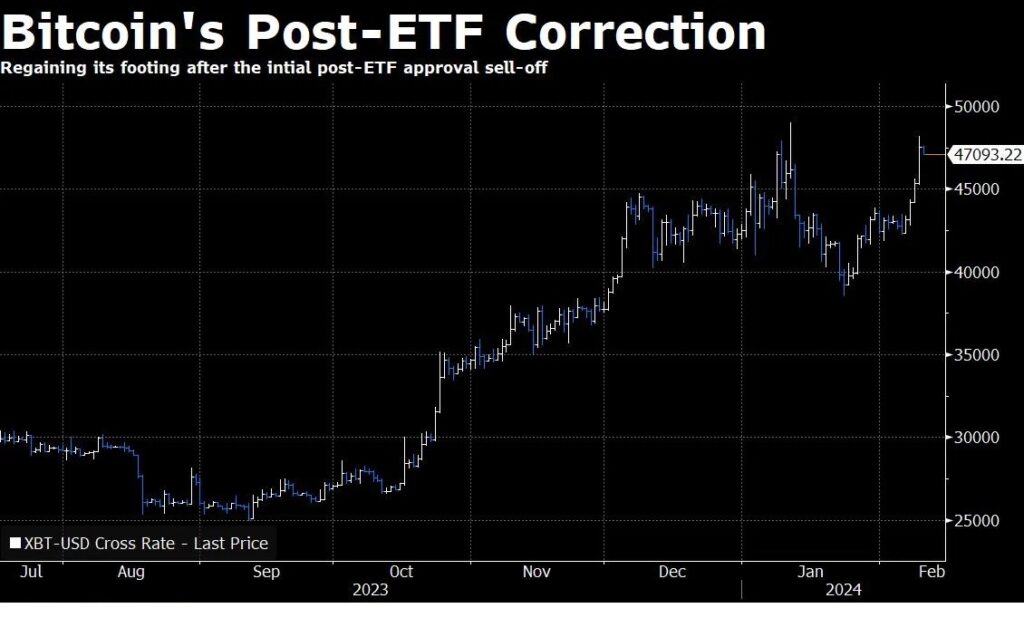

The recent surge of Bitcoin to $50,000 is just the tip of the iceberg. Michael Howell, CEO of CrossBorder Capital, offers us a window into the future of global liquidity and the role the Fed will play in the coming months. The idea of concluding Quantitative Tightening for political reasons and to finance the US debt makes us reflect on the cyclical nature of the economy and the constant search for balance.

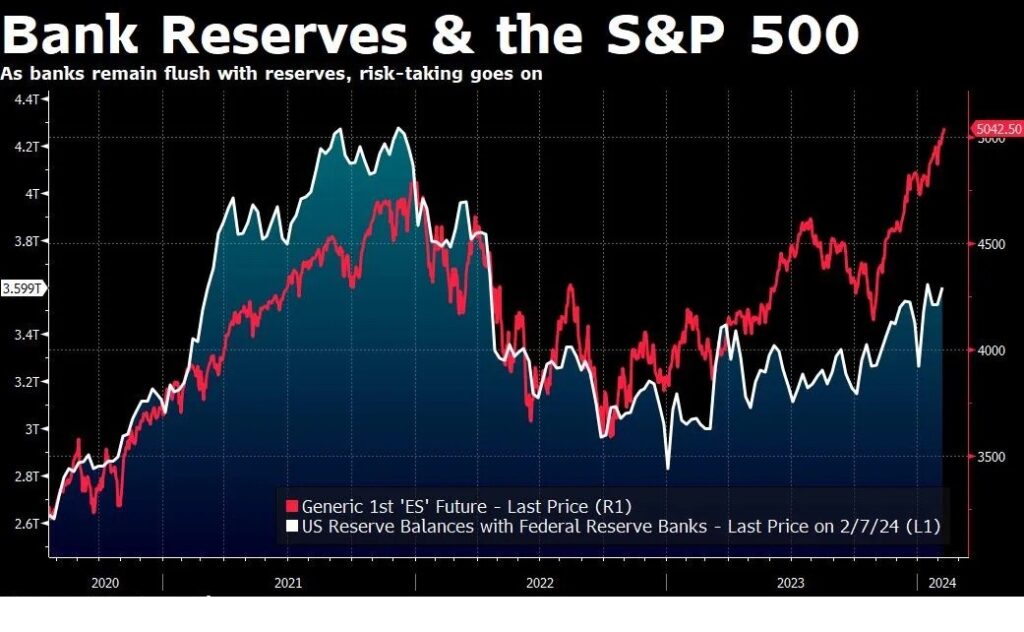

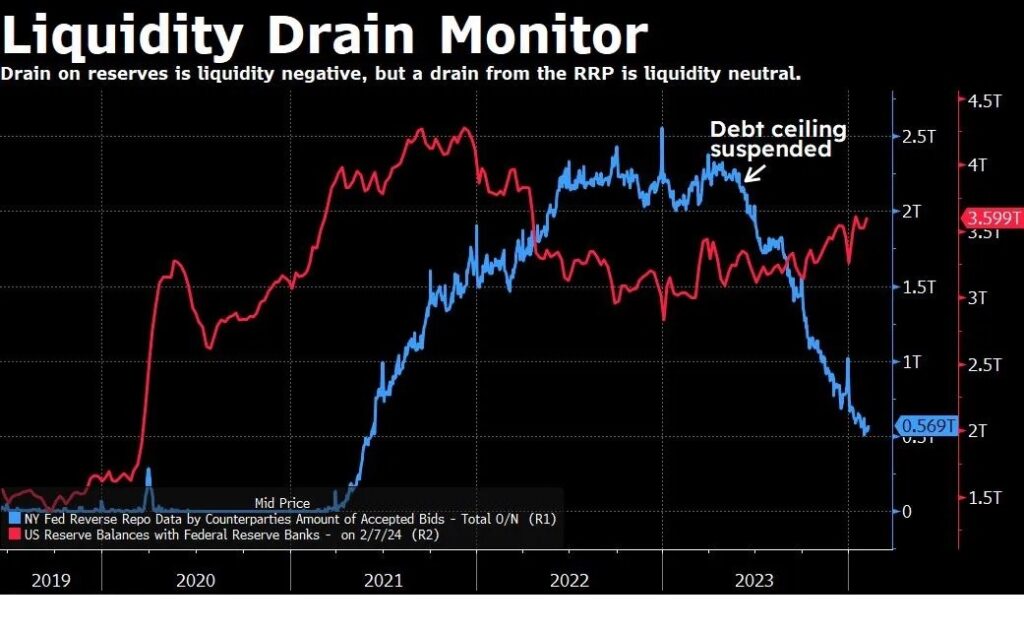

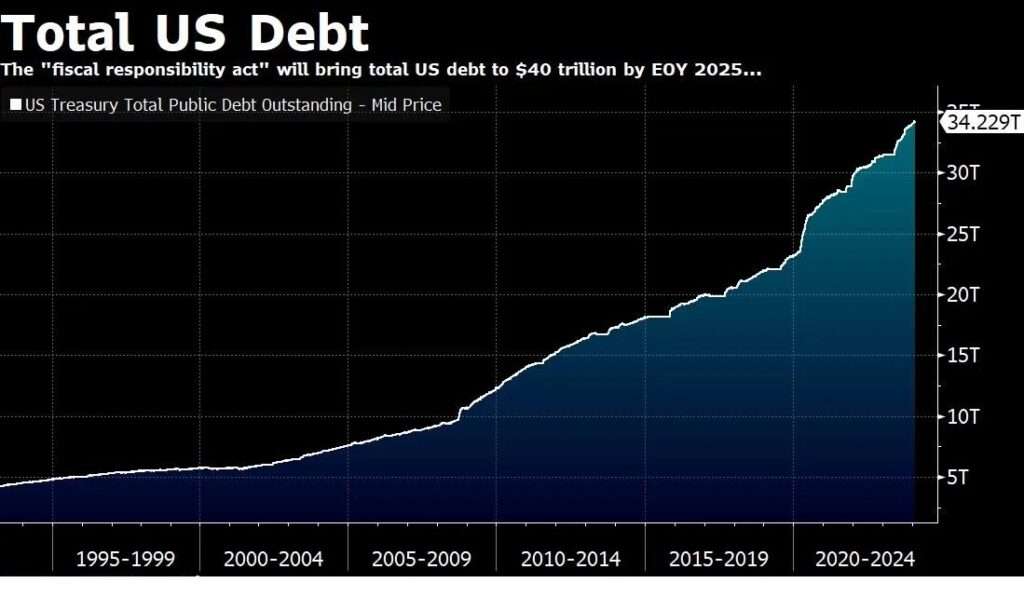

In pre-election years, liquidity injections become a political tool as much as an economic one, with the government seeking to stimulate markets to maintain a facade of stability. Howell’s forecast, that the US debt will reach $50 trillion by 2034, underscores the urgency of sustainable long-term strategies.

Howell’s thoughts on a wave of direct purchases of US Treasuries by the Fed and the implication that banks may not be able to sustain this burden alone, lead us to reflect on the interdependence of financial institutions and the crucial role of the Fed in balancing the system.

In this context, China’s strategy to inject liquidity to fight its economic crisis becomes a crucial part of the global puzzle. Debt monetization, seen as inevitable by Howell, raises critical questions about which assets represent true “safe havens” in times of uncertainty.

Howell’s analysis invites us to look beyond the figures and reflect on the deeper meaning of liquidity, debt, and investment. As Bitcoin and gold move in sync with global liquidity cycles, they remind us that our economy is as much about trust and perception as it is about concrete numbers.

In an ever-evolving economic world, our understanding of what it means to “invest” is expanding. As we explore this changing landscape together, we realize that our greatest asset might not be gold or Bitcoin, but our ability to adapt and find new paths for sustainable growth.

For a deeper dive into how these developments could impact our business and marketing strategies, keep following me on mariofiglioli.com.

Mario Figlioli, navigating together through the waters of marketing and business.