China and Economic Stimuli: What Are the Implications for Global Markets?

Dr. Mario Giovanni Figlioli — MARKETING AND BUSINESS — KULASSA–HERMES UNIVERSITY — INFINITY — ARKON OMINA

China, the world’s second-largest superpower, has recently turned on the taps of its economy, injecting trillions of Yuan to stimulate growth. These interventions, which range from reducing mortgage rates to injecting liquidity into the stock market, will not only strengthen the Chinese economy but may also have far-reaching effects on global markets, including risk assets such as ETFs, stocks, and cryptocurrencies.

I see these Chinese stimuli as a turning point for global investors. China’s economic influence is such that any change in its monetary policies immediately reverberates through global financial markets. When China makes a move, the global economy feels the ripple, setting off chain reactions across every corner of the world.

In the current context, we are potentially facing a recovery in emerging economies, driven by Chinese stimuli. However, we must not forget the risks of a “reverse crash,” a phenomenon that occurs when asset prices rise too quickly, creating an unsustainable bubble.

The Positive Effects of Chinese Stimuli

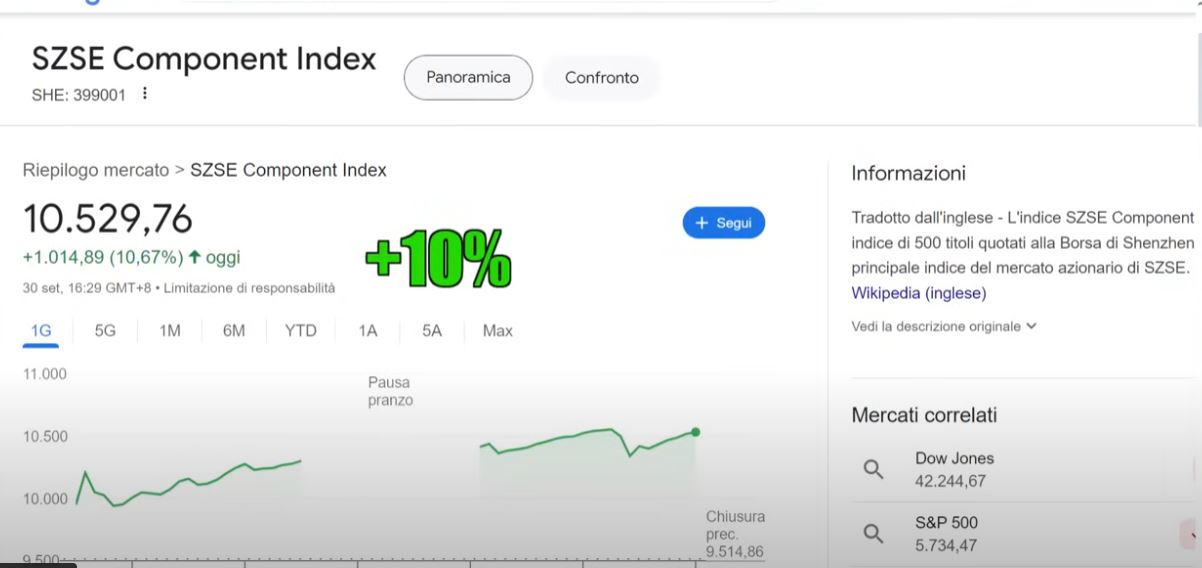

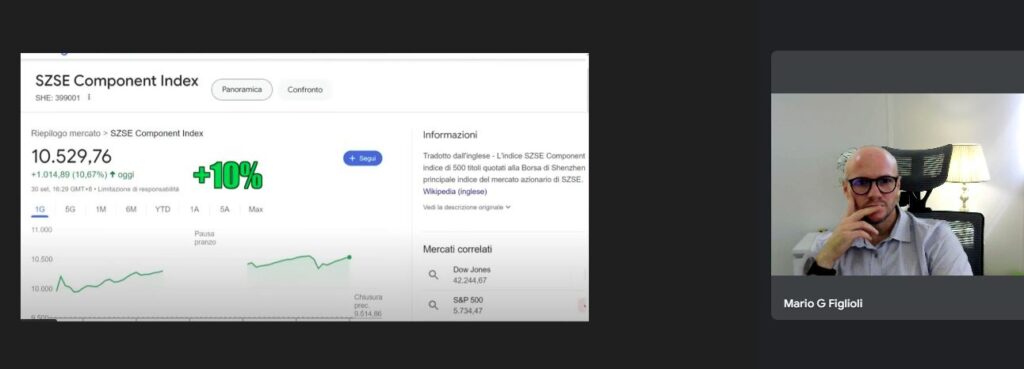

- Increased Market Confidence: With a 500 billion Yuan injection plan and the creation of instruments to facilitate equity investments, we are already seeing a significant surge in Chinese stock markets. Companies like Alibaba, JD.com, and Pinduoduo are posting double-digit gains.

- Rise in Risk Assets: With expansionary monetary policies, risk assets, such as cryptocurrencies and ETFs, tend to benefit from increased liquidity in the market. For example, Bitcoin may reach new highs in the coming years, as investors seek safe havens against the devaluation of fiat currencies.

- Boost to the Real Estate Sector: China is working to restore confidence among its citizens by reducing mortgage rates and stimulating property purchases. This will strengthen consumer confidence, which is a key factor in sustainable economic growth.

Challenges on the Horizon

Despite the stimuli, we must also consider potential risks. The excessive creation of liquidity could lead to an unsustainable rise in prices, creating a financial bubble that, if it bursts, could damage not only China but global markets as well. Additionally, we must keep an eye on possible “black swans”—unexpected events that could suddenly change the global economic landscape.

As always, the winning strategy is to stay vigilant and diversify. For investors like us, the current environment could offer interesting opportunities, especially for those willing to take calculated risks. Personally, I will continue to invest regularly in ETFs, maintaining a consistent accumulation strategy.

China, with its enormous economic influence, will continue to play a central role in global financial markets. Therefore, it’s crucial to closely follow developments and be prepared for both opportunities and potential challenges that may arise.

What are your expectations regarding the Chinese stimuli? Let me know in the comments!

Dr. Mario Giovanni Figlioli